Something deep beneath the American landscape is once again catching the world’s attention. A newly released map sheds light on where the country’s hidden wealth truly lies, a revelation that could reshape how we view the nation’s natural treasures. These gold deposits, long veiled by geology and time, now stand at the center of renewed curiosity, drawing miners, investors, and dreamers back toward the ground that still holds untold stories.

Where the nation’s new ounces actually begin

Start with deposit types, since those shape scale and location. Lode means gold is locked in rock, while placer means loose grains concentrated by running water. More than forty lode mines and several placer sites supplied U.S. output in 2024, mostly across the West and in Alaska during that year.

The largest twenty-six mines delivered nearly all domestic volume, because their throughput stays high and steady. Commercial metal then moved through roughly fifteen refineries before fabricators shaped it. That chain links geology to the market so gold deposits identified on a map connect with bars, coins, jewelry, and parts today.

The U.S. Geological Survey’s Mineral Commodity Summaries 2025, prepared by Kristin N. Sheaffer, pulls these threads together. Because its tables align definitions and sources, the update explains where U.S. gold begins and why. Readers get a consistent baseline for state roles, deposit types, and the infrastructure that moves metal efficiently.

Nevada’s Carlin belt and the scale of gold deposits

Nevada leads U.S. production, near seventy percent in 2024, because the Carlin Trend concentrates microscopic gold in vast, mineable rock. Open-pit and underground methods work together, as processing handles fine particles at industrial scale. That district’s structure turns many gold deposits into long-life operations with steady output and learning curves.

The state adds deep mining infrastructure, an experienced workforce, and long permitting practice, so projects advance more predictably. Alaska ranks second at about sixteen percent, though sites spread across remote terrain. Operators combine hard-rock and large-scale placer systems, while weather, logistics, and energy planning shape schedules, costs, and safety choices.

Carlin-type ore allows economies of scale, since similar geology repeats across deposits and plants. Companies reuse designs, share supplies, and train crews faster, which lowers unit costs and improves recovery. Those compounding gains explain why Nevada towers over the field and why investors focus on belts, not scattered prospects today.

Alaska’s rise and the long-range resource picture

Alaska’s mix of hard-rock mines and large placer fields feeds a diversified stream, while some districts tie into copper systems. Gold often rides with other metals, as porphyry centers host broad halos. Those links matter because gold deposits can be developed alongside copper, which spreads costs and supports shared infrastructure.

The United States holds about thirty-three thousand tons of identified and undiscovered resources, based on government estimates. Nearly one quarter of the undiscovered portion likely sits in porphyry copper deposits, which connect exploration programs across the West and Alaska. That signal guides portfolios, service capacity, and long-term training pipelines nationwide.

Employment across U.S. mine and mill sites hovered near twelve thousand workers in 2024, because production concentrates in very high-throughput nodes. Fewer, larger plants move ore quickly, while automation improves safety. Communities feel the impact through steady payrolls, contractor demand, and infrastructure upkeep tied to reliable haul roads and power.

Prices, demand, and recycling reshape gold deposits economics

Market tone matters because price sets project timing and cash flow. In 2024, gold set forty record highs, noted Louise Street of the World Gold Council, while investor behavior turned late in the year. Shifts in appetite changed flows into bars, coins, and exchange products, as macro stories evolved globally.

The average U.S. government estimate for 2024 reached about two thousand four hundred dollars per troy ounce, up roughly twenty-three percent from 2023. Higher prices weighed on jewelry volumes, yet they lifted total dollar demand. Retailers adjusted product mixes, while consumers favored durable pieces and trusted brands during uncertainty worldwide.

Global use split mainly among jewelry at forty-five percent, official sector near twenty-one percent, bars at nineteen percent, coins and medals around seven percent, and electronics near six percent. At home, recycled supply reached about ninety tons, roughly forty-five percent of consumption, although volumes slipped around six percent year-over-year domestically.

Global production, byproducts, and the routes from pit to product

World mine output stood near three thousand three hundred tons in 2024. China, Russia, Australia, Canada, then the United States led, in that order. America’s resource base is far larger than annual output, so long potential remains, while timing depends on economics, permitting, and technology. Treasury records gold at $42.2222.

About seven percent of U.S. supply comes as a byproduct when domestic base-metal ores are processed, chiefly copper. Smelters and refineries recover that gold and raise purity, so it reenters standard channels. Because metals share plants and logistics, planners study multi-metal circuits when they estimate capacity and future costs closely.

Fabricators cluster in New York and Providence, with smaller hubs in California, Florida, and Texas. Trade routes add partners, since Switzerland and Canada handle bullion, while Mexico and Colombia ship doré to refineries. Those paths keep metal moving even when mines shift, so maps remain useful as conditions change nationwide.

How the map guides the next ounces and investments

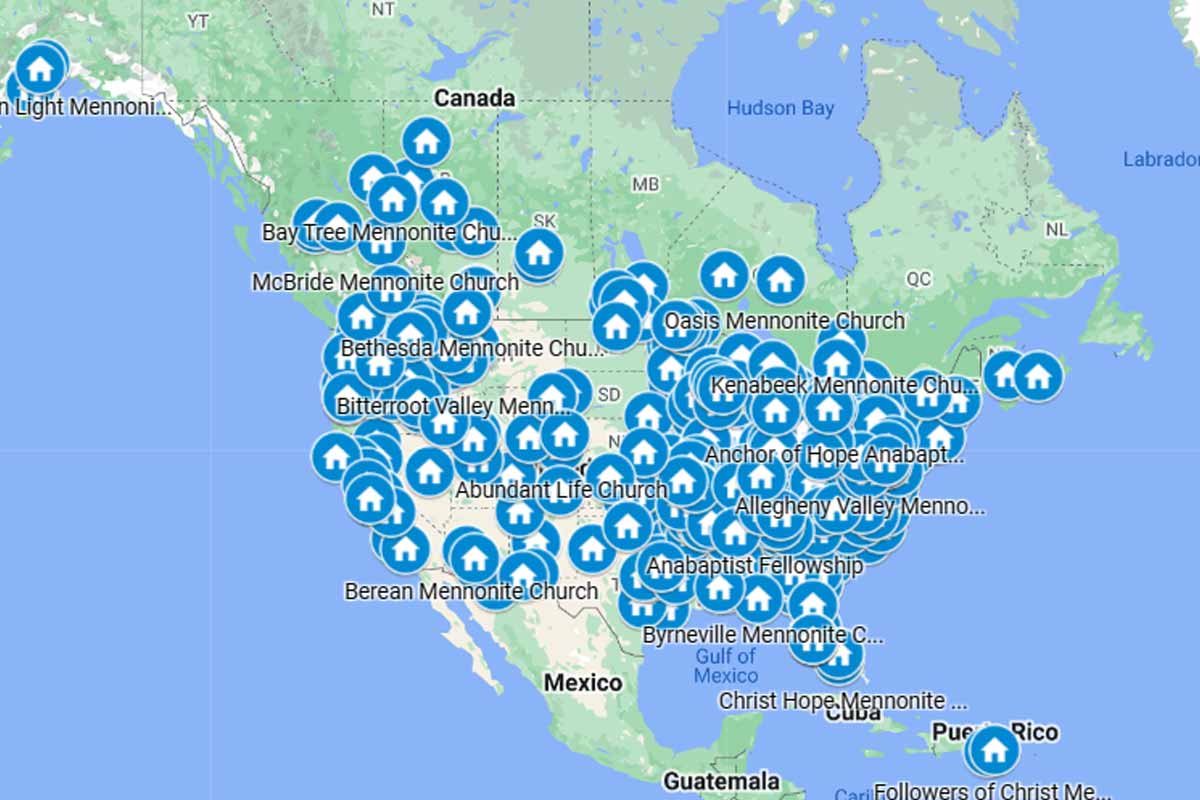

The picture is clear without losing nuance. Nevada dominates the source map, Alaska adds a strong second stream, and several Western states contribute smaller flows. Refineries, fabricators, and trade hubs keep metal circulating as prices, costs, and capital shift. Because these links amplify geology, future projects will cluster where gold deposits scale well, tie into shared plants, and align with markets. Maps help investors time risk, while communities plan skills and services.